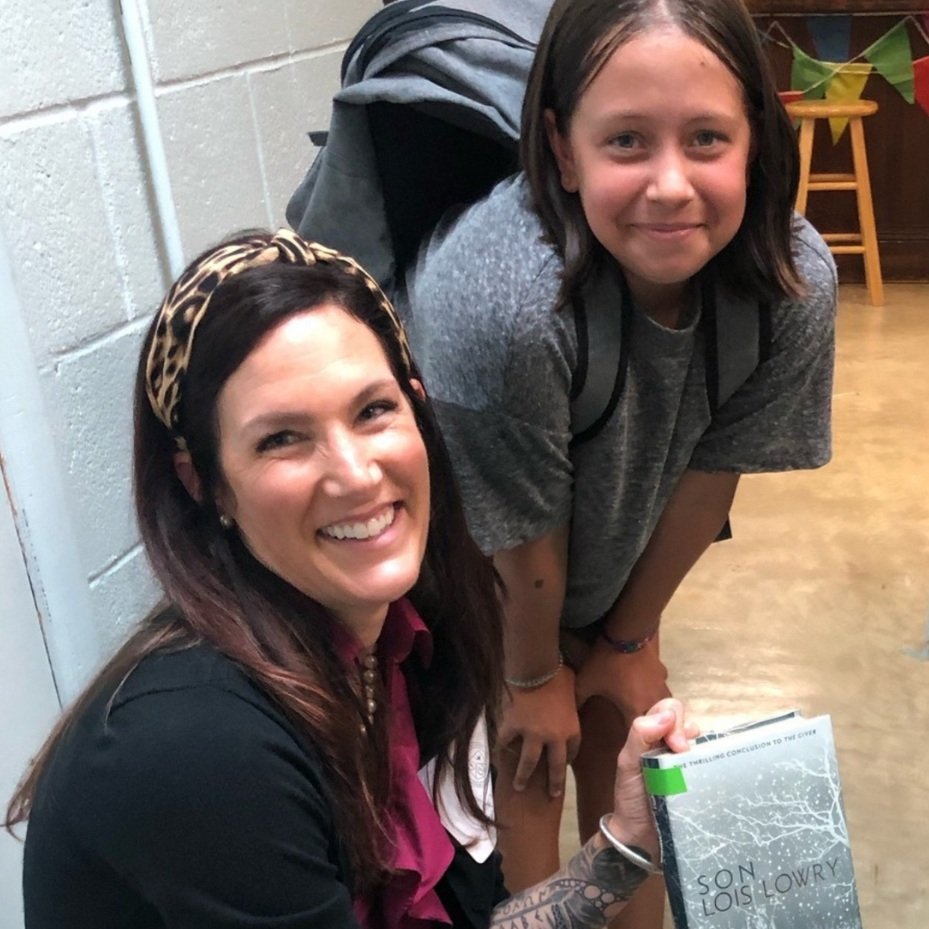

Your gift to broadwater ensures that our students have access to a strong independent school education right here on the Eastern Shore of Virginia.

For almost 60 years, Broadwater Academy has offered students an exceptional educational experience. Your gift to the school means that each Broadwater student has the support and guidance he or she needs to become a well-educated, respectful and civic-minded young person, ready to embrace opportunities and challenges on the Eastern Shore and beyond. THANK YOU!